How My Crypto Trading Engine Works: A Smart Approach to Market Signals

My crypto trading engine is a powerful, automated tool designed to help traders spot high-potential buy and sell opportunities in the cryptocurrency market. It analyzes market data, generates trading signals based on multiple technical indicators, applies strict filters to ensure quality, and sends alerts via email for manual execution. Built with reliability and precision in mind, it’s like having a tireless trading assistant that scans the market 24/7 and only notifies you when the best setups appear. Here’s how it works in simple terms.

Step 1: Gathering Market Data

The engine starts by collecting real-time price data for a variety of cryptocurrency pairs (e.g., BTC/USD, ETH/USD) from a trusted exchange. It pulls historical price and volume information across different timeframes, such as short-term (minutes) and longer-term (hours), to get a complete picture of market behavior. It also fetches broader market metrics, like Bitcoin’s dominance (how much of the total crypto market is controlled by Bitcoin) and the performance of top coins, to understand the overall market environment.

Step 2: Analyzing Price Patterns

Using the collected data, the engine calculates several technical indicators to identify potential trading opportunities. These include:

- Momentum Indicators: Measures like the Relative Strength Index (RSI) to spot when a crypto is overbought (potentially ready to fall) or oversold (potentially ready to rise).

- Trend Indicators: Moving averages to determine if the market is trending up (bullish) or down (bearish).

- Volume Analysis: Checks for spikes in trading volume, which often signal strong market moves.

- Price Gaps: Identifies “fair value gaps,” where price jumps leave untested levels that may act as support or resistance.

By combining these indicators across multiple timeframes, the engine creates a “confluence score” for each pair, rating how strong the buy or sell signal is. A higher score means more indicators align, increasing confidence in the trade.

Step 3: Filtering for Quality

Not every signal is worth trading. The engine applies strict filters to weed out low-quality setups and focus on the best opportunities:

- Trend Alignment: Ensures the signal matches the broader market trend. For example, it avoids sell signals in a strong uptrend.

- Liquidity Check: Confirms the pair has enough trading volume to avoid risky, illiquid markets.

- Market Conditions: Skips altcoin buys when Bitcoin’s dominance is too high or rising, as this often signals weaker altcoin performance.

- Confirmation: Waits for a short-term price movement to confirm the signal, reducing false positives.

- Daily Limits: Caps the number of alerts per day to prevent over-trading.

These filters act like a gatekeeper, ensuring only high-probability trades make it through.

Step 4: Calculating Trade Details

For signals that pass the filters, the engine calculates key trade parameters:

- Entry Price: The current market price to enter the trade.

- Stop-Loss: A safety level to exit if the trade goes against you, based on recent price volatility.

- Take-Profit: A target price to lock in profits, set at a favorable risk-to-reward ratio (e.g., aiming for twice the potential gain vs. loss).

These details are tailored to each signal, helping traders manage risk effectively.

Step 5: Sending Alerts

Finally, the engine sends an email alert with all the trade details, formatted as a clear, easy-to-read table. The email includes the pair, buy/sell direction, confluence score, reasons for the signal (e.g., “oversold RSI, bullish trend”), and the calculated entry, stop-loss, and take-profit levels. Traders can review the alert and decide whether to place the trade manually on their exchange.

Why It’s Smart

The trading engine’s strength lies in its systematic approach. By combining multiple indicators, rigorous filtering, and automated alerts, it saves traders time and reduces emotional decision-making. It’s designed to catch high-probability setups while avoiding common pitfalls like low-liquidity traps or counter-trend trades. Whether you’re a busy trader or just want a reliable second opinion, this engine provides actionable insights in a volatile market.

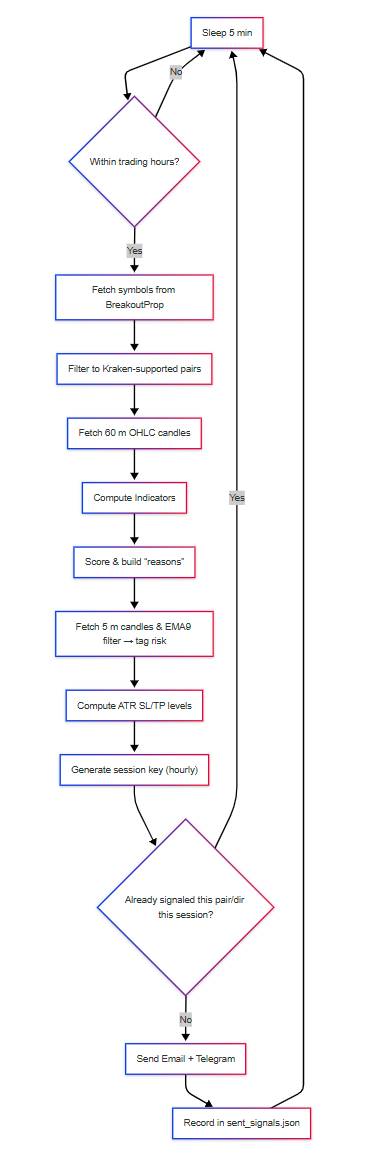

Flowchart: How the Engine Works

Below is a visual representation of the trade engine’s workflow: